Weekly Crypto Break February 20

Weekly Newsletter

This week, the

market narrative was led by developments around the Clarity Act in the United States, keeping the focus on the regulatory agenda and institutional positioning. Alongside the Clarity Act discussion, key topics included Aave’s expansion in RWA deposits within DeFi, Base’s evolving OP Stack strategy on the infrastructure side, and Aptos’ supply model debate in tokenomics.

On the institutional front, Strategy purchased 2,486 BTC, bringing total holdings to 717,131 BTC. BitMine acquired approximately 45,759 ETH, increasing its total to 4,371,497 ETH.

Aave Reaches 1 Billion USD in RWA Deposits

On February 19, DeFi platform

Aave announced that the total value of Real World Assets (RWA) on the protocol reached 1 billion USD. The report notes that deposits in Aave Horizon, Aave’s tokenized RWA-focused initiative, rose to 600 million USD as of January 2026 and have accelerated further in a short period.

Why it matters This milestone comes at a time when crypto investment products have recorded net outflows for four consecutive weeks. According to CoinShares, total outflows last week reached 173 million USD, while cumulative outflows over the past four weeks totaled 3.74 billion USD. Despite this broader backdrop, continued growth in

RWA focused activity within DeFi suggests institutional interest has not fully weakened. Instead, it points to the development and early market adoption of more institution-friendly products within the sector.

Aptos Supply Model in Focus as Cap and Burn Mechanisms Are Discussed

The Aptos Foundation has brought forward a framework that considers updating APT’s current uncapped supply structure by introducing a maximum supply limit. The outlined approach includes capping total supply, reducing emission rates, and adding burn mechanisms that could influence long-term supply dynamics.

Key elements highlighted in the proposal include setting a maximum supply of 2.1 billion APT, introducing updates to transaction fees, and permanently burning a portion of those fees. The framework also considers staking Foundation-held APT to reduce the circulating supply.

Why it matters Tokenomics updates of this nature are closely monitored in

proof-of-stake networks due to their potential impact on security and incentive balance, the effectiveness of ecosystem incentives, and long-term supply dynamics. The report also notes that potential changes to the 2026 token unlock schedule remain a topic the market is watching, given the possible implications for supply conditions.

Clarity Act Targets April Timeline

Senator Bernie Moreno said in an interview with CNBC that the CLARITY Act is aimed at passing Congress preferably by April. According to Moreno, the central issue remains market structure, and the bill is expected to move forward for formal consideration once the crypto industry, the banking sector, and Congress converge on a common framework.

Why it matters Progress on the CLARITY Act shapes expectations for a clearer regulatory framework for digital assets in the United States. Key areas referenced in the bill include:

-

The role and boundaries of stablecoins

-

Market structure and the authorities and responsibilities of market participants

-

Customer asset protection and custody standards

-

Provisions restricting or prohibiting a CBDC

-

The AML framework and measures addressing illicit finance

-

The treatment of DeFi, including how developers may be scoped under certain conditions

Strategic Shift at Base Signals a New Phase for OP Stack

Positioned as Coinbase’s Ethereum Layer 2 network, Base is planning a meaningful infrastructure update that would reduce its reliance on

Optimism’s OP Stack.

OP Stack has been positioned as a modular, open-source framework enabling institutions and development teams to build their own Layer 2 chains.

Why it matters In the Superchain and shared-standards narrative, ecosystems built on the same technology stack were expected to scale together and strengthen interoperability. A roadmap that makes Base less dependent on OP Stack could raise questions about how this standardization approach will evolve. Competition across the Layer 2 landscape is accelerating not only at the user and application layer, but also through infrastructure choices and long-term technology roadmaps.

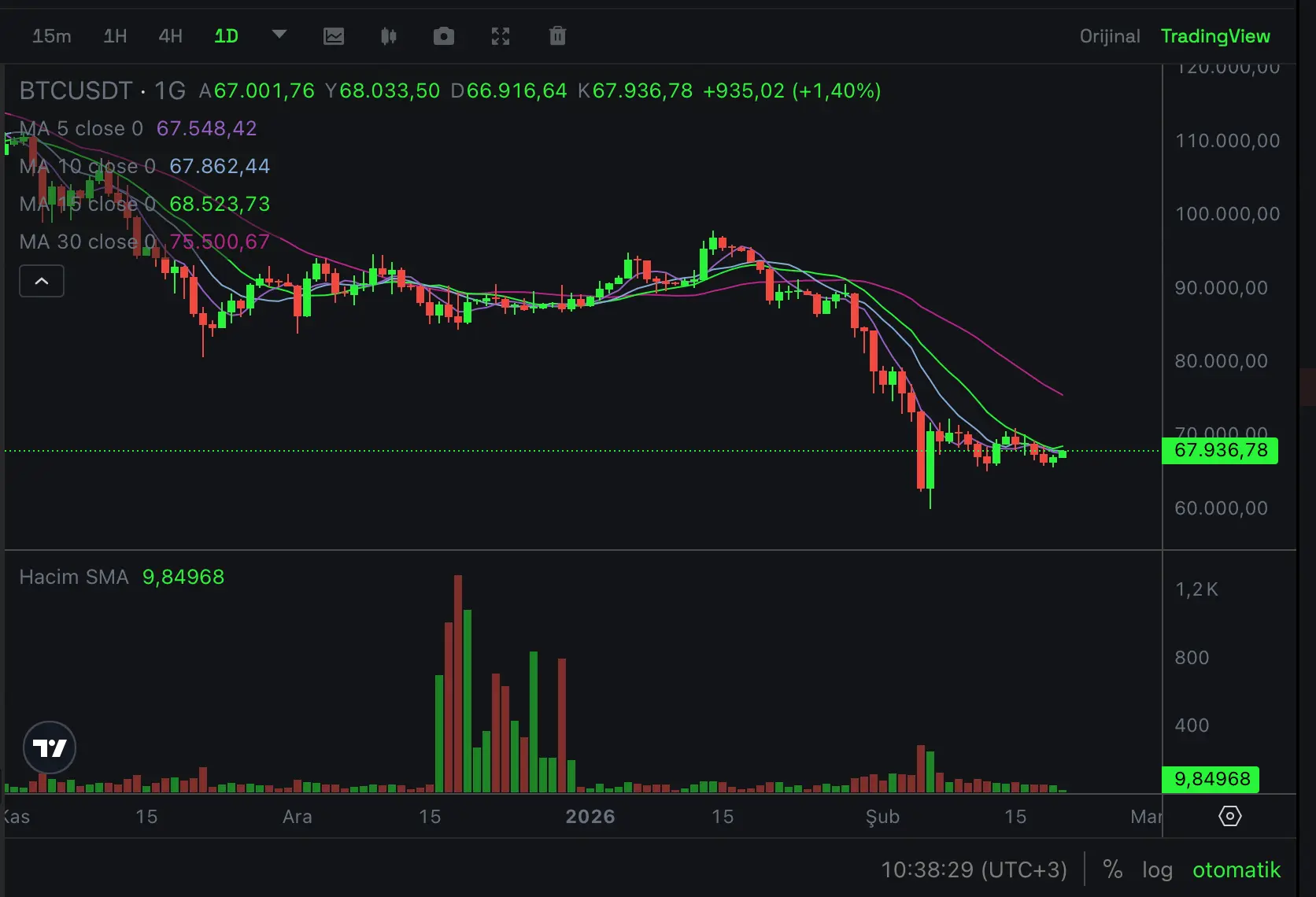

Bitcoin Price Chart

Throughout the week,

Bitcoin pulled back to 65,700 USD and was trading around 67,900 USD at the time of writing. Bitcoin is expected to close the week by approximately 2.5%, while Bitcoin ETFs recorded 404 million USD in net outflows over the week.

Rising geopolitical tensions globally may lead investors to adopt a more cautious stance toward risk assets, potentially increasing demand for safe havens as well as cash and cash-like instruments. In this context, the 65,000 USD level remains a key reference point closely watched for Bitcoin’s near-term market direction.

Ethereum Price Chart

Ethereum fell to 1,900 USD during the week and was trading around 1,964 USD at the time of writing. On the ETF side, net outflows of 123 million USD were recorded over the week.

For Ethereum, whether the 2,000 USD level can be regained remains one of the key reference points for the near-term outlook. Based on the current picture, Ethereum is expected to close the week up by approximately 2%.

Legal Notice

The information, comments, and evaluations contained in this content do not constitute investment advice. This content is not intended to be prescriptive in any way and is intended to provide general information. It does not constitute investment advice. CoinTR cannot be held responsible for any transactions made based on this information or any losses that may arise.

Recommended

- Weekly NewsletterClarity Act Uncertainty and USDT Signal: Market Liquidity Tracking The key developments in the cryptocurrency market this week are as follows: Over the past seven days, there has been a notable flow of news, particularly in the areas of regulation and institutional players. In the U.S., the Clarity Act discussions ended without a concrete decision, bringing the debate over the position of stablecoins back into focus. On the other hand, signs of weakening in the USDT market indicate that liquidity conditions need to be closely monitored. From the

2026-02-13